Machinery Breakdown Insurance Malaysia

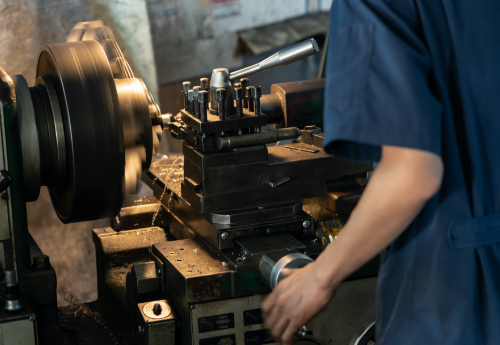

Machinery Breakdown Insurance in Malaysia is a special type of insurance policy. It extends insurance coverage to businesses and industries against sudden and unforeseen machinery breakdowns. The insurance cover aims to shield businesses from financial losses due to machinery breakdown that may disrupt operations and result in costly repairs or replacements.

Salient Features of Machinery Breakdown Insurance in Malaysia:

1. Sudden and Unforeseen Malaysian Breakdown :

o Usually, the Malaysian policy will cover any sudden and unforeseen mechanical or electrical failure. This includes damage from human error, electrical malfunction, or mechanical defects.

2. Repair and Replacement Costs:

o The insurance pays for the machinery's repair Malaysian costs or replacements. This might include Malaysian parts and labor costs to get the machinery up and running.

3. Protection for a Wide Range of Malaysian Machinery:

o The insurance policy can cover different machinery, starting from manufacturing equipment to construction machinery to electrical systems, HVAC systems, and many others depending on the industry.

4. Malaysian Business Continuity Support:

o It helps minimize business downtime by supporting business operation continuity. The insurance covers breakdown costs and repairs.

5. Optional Add-Ons:

o Some policies have additional coverage available, such as consequential losses-coverage for lost profits, for example-due to the breakdown of the machinery, or damage that arises from extraneous causes such as fire or explosion.

Why Malaysian Businesses Need Machinery Breakdown Insurance:

• Malaysian Industrial Dependence on Machinery: Malaysia has a sizeable base of industries and manufacturing concerns where machinery forms an integral part of the production process. A breakdown in the machinery can bring the entire production to a grinding halt and result in huge losses.

• Hedging against financial losses: Without this cover, Malaysian businesses are required to incur the full cost of repairs or replacement that might be very expensive, especially for large machinery or specialist ones.

• Regulatory and Safety Compliance: Many industries in Malaysia come under tight safety and operation directives. The availability of such insurance ensures that any breakdowns are timely dealt with without compromising on such regulations.

Industries That Generally Invest in Machinery Breakdown Insurance:

• Malaysian Manufacturing and Production Plants

• Construction and Engineering Malaysian Companies

Hospitality-for example, HVAC systems. Agricultural Operations-such machines as tractors and harvesters. Exclusions Usually, Machinery Breakdown Insurance will exclude the following from cover: Normal wear and tear, Gradual deterioration due to aging, Intentional damage or misuse, Known defects before the purchase of policy coverage, and Losses from war, terrorism, and natural disasters. Cost Factors Machinery

breakdown insurance costs in Malaysia depend on a number of factors:

• Age and Type of Machinery: Newer Malaysian machinery might have lower premium Malaysian rates since a breakdown is likely low.

• Industry and Level of Risk: High-risk industries or categories of machinery that are prone to high-frequency breakdowns are likely to command more premium.

• Malaysian Policy Limit and Deductibles: Higher limits with lower deductibles are sure to increase costs.

In Malaysia, where industries are highly dependent on machinery for their operations, Machinery Breakdown Insurance becomes fundamentally unavoidable. Besides, as it covers the risks of failure of machineries, businesses will always be covered against such eventualities that could throw them out of business. Hence, Machinery Breakdown Insurance assures the businessperson of peace of mind.

Machinery Breakdown Insurance provides many considerable benefits to many business entities in Malaysia, particularly those whose dependence on equipment and machinery is high. Key benefits include the following:

1. Malaysian Financial Protection

• Insurance against Repair and Replacement Costs: The main benefits include financial cover against some of the high costs that relate to machinery repairs or replacement. Without insurance, such costs would come directly from the concerned businesses and, hence, might be really high if the machinery is large or highly specialized.

• No Unplanned Expenditures: Sudden failure of a machine can make an enterprise spend unplanned amounts of money. This is where the insurance will guarantee such eventualities are dealt with in a decent way and cash flow is strained as little as possible.

2. Minimizes Downtime

• Business Continuity: The failures of these pieces of equipment translate into lost Malaysian production and disruptions of services because of operation downtime. An insurance cover helps to cover repair costs as soon as possible for Malaysian businesses to restart operations without much interference and lost income.

• Temporary Malaysian Machinery: Policies of insurance in certain cases also offer cover on renting temporary machinery while repairs are in progress, therefore allowing a business to operate without disruptions.

3. Comprehensive Cover

• Covers a wide range of risks: Machinery breakdown insurance covers all types of mechanical or electrical failures due to defects in parts, human error, voltage fluctuations, short circuiting, and sudden and unforeseen breakdowns, which are really expensive to deal with.

• Protection for different machinery types: It insures different types of Malaysian machinery employed across a wide range of industries, including manufacturing, construction, agriculture, and energy, making th e insurance versatile to adapt to different Malaysian business requirements.

e insurance versatile to adapt to different Malaysian business requirements.

4. Avoid Loss of Income

• Minimizes Loss of Income: With the insurance contributing to quickly reducing machinery breakdown and getting businesses on their wheels right away, such losses of income that one might misplace during machinery downtime are mitigated. Other policies also cover business interruptions in order to make up for losses in income during repairs.

• It reduces long-term financial impact: Repair and replacement costs, along with the cost of lost time, have more long-term financial implications, particularly for smaller and medium-sized businesses. The insurance lessens these risks and acts as a shock absorber for such businesses to continue operating financially.

5. Better Management of Risks

• Uncertainty Protection: The failure of machinery is generally an unpredictable phenomenon. Hence, through insurance, policies allow this unexpectedness of the occurrence of risk to businesses through increased management of uncertainty linked with the failure of machinery. If the risk is transferred to an insurer through insurance, no business concern is required to focus on its core operations, bugged by fears of unexpected breakdowns.

• Safety Standards: The majority of industries need to operate in good form with safety and operational standards. Malaysian Machinery breakdown insurance ensures that any breakdowns are fixed promptly and properly, thus helping a Malaysian business not violate industry regulations.

6. Peace of Mind

• Core Business Concentration: In the case of machinery breakdown insurance, business owners and managers would focus on the running of their operations void of nervousness over impending breakdowns and subsequent financial losses.

• Maintenance Teams Face Less Stress: It supports maintenance teams in that they are confident when major breakdowns happen, they have a supporting financial safety net to repair or replace critical machinery.

7. Malaysian Policies Can Be Tailored

• Customized to Specific Needs: Most insurers in Malaysia have machinery breakdown insurance policies that can be tailored to suit individual needs with respect to industry, type of machinery, and risk exposure of the business enterprises.

• Additional Coverage Options: Consequential losses for lost profits caused by production delays, accidental damage due to fire or explosion, and even Malaysian coverage for spare parts are just some of the optional add-ons that businesses can get.

8. Malaysian Offers Protection from Technological Failures

• Advanced Machinery Protection: Today, business operations rely on machinery that is ever-increasingly dependent on sophisticated technology. The cost of electrical failure or malfunction is high. Machinery breakdown cover provides insurance against all kinds of electrical failures, including software malfunction and electronic breakdown.

9. Compliance with Malaysian Lenders' Requirements

• It facilitates financing: In this case, machinery breakdown insurance may be a requirement set by most lending and financial institutions while giving loans or financing to businesses, especially when the equipment has been used as collateral. Such a condition may thus facilitate loans or financing in new machinery purchases.

Malaysian Machinery Breakdown Insurance in Malaysia acts as an essential cushion for most businesses that depend on machinery through everyday activities. This provides protection against Malaysian financial losses due to these incidences, minimizes operational disruptions, and ensures business continuity. Further, it allows better risk management. Since policies can be tailored, they offer protection from the large variance in mechanical failure, bring ease to business owners, and protect the long-term profitability of their business.

While there are various advantages associated with Machinery Breakdown Insurance in Malaysia, the disadvantages and limitations also abound. Here are some of the possible disadvantages which may be ascribed to this class of insurance:

1. Premium Malaysian Costs

High Insurance Costs: either due to Old Age or High-Risk Machinery in certain circumstances, Malaysian machinery breakdown insurance may be too expensive such as in the case of older machinery or equipment generally  subject to frequent breakdowns. Sometimes, these businesses deal with a number of Malaysian machines or specialized equipment; hence, the insurance can cost fairly high.

subject to frequent breakdowns. Sometimes, these businesses deal with a number of Malaysian machines or specialized equipment; hence, the insurance can cost fairly high.

• Rising Premium with the passage of Time: As the Malaysian machinery becomes older, the increase in the possibility of breakdowns increases, which means an increase in premium. The continuous rise in the cost of insurance may be unaffordable for an enterprise.

2. Limited Coverage

• Exclusions: Machinery breakdown insurance as a rule does not cover specific exclusions, including normal wear and tear, corrosion, deterioration over a period of time, and also damage due to improper maintenance. Under such exclusions, businesses may have to bear the repair or replacement costs.

• No Cover for Consequential Losses: Generally speaking, consequential losses arising from the breakdown, such as loss of profit, delays in production, or interruption of business, are generally not covered under a standard policy unless added by extension. This means a business has to buy additional covers to cover these risks, adding to the costs.

3. Stringent Maintenance Requirements

Maintenance Compliance: Most of the insurance Malaysian policies require the business enterprises to pursue rigorous schedules and standards of maintenance. Lack of machinery maintenance as specified or recommended by the manufacturer or according to the guidelines of the Malaysian insurance might render the insurance policy null, making it unprotective at times of breakdowns.

• Trouble in Proving Compliance: As in the event of a claim, it is common for insurers to request proof that machinery has been properly maintained. If businesses cannot provide detailed records, their claim may be rejected even if the breakdown is covered by the policy.

4. Possibility of Rejection of Claims

• Cause of Breakdown Disputes: The insurer and the business may disagree over the cause of the breakdown to machinery. If, for instance, the insurer asserts that the breakdown is as a result of wear and tear, as opposed to an unexpected failure, the claim will be refused.

• Claims Process: Sometimes, claiming is a lengthy process; therefore, the payment regarding repair or replacement takes quite a long time. That means the longer downtime and loss for the business.

5. Limitation of Machinery Range

Specific Exclusions for Types of Machinery: Sometimes, specific machinery types are not covered, usually because the risk is too great, or there are high costs for repair. Those businesses with highly specialized equipment often find it difficult to find proper coverage, or their premiums become very high.

• More Limited Coverage for Older Equipment: The possibility of breakdowns increases as machinery gets older, so insurance companies sometimes restrict or exclude cover. It would be impossible for a business with outdated equipment to get adequate insurance protection.

6. Deductibles and Malaysian Policy Limits

The deductions are normally very high for most machinery breakdown Malaysian policies, in which the business bears most of the expenditure related to the repair or replacement cost before the insurance policy can relieve it from the impact of any such disaster. High deductibles thereby cut down the financial cushion provided by a Malaysian policy.

• insurance policy limits: All insurance Malaysian policies have limits, meaning if the repair cost or replacement of machinery is higher than the limit of the Malaysian policy, then the difference needs to be paid by a business. This might still involve considerable out-of-pocket expenses for a Malaysian business in case of large-scale breakdowns.

7. Complexity in Customization

Complicated to Customize: Although several insurance companies offer tailored variants, tailoring the policy in conformity with your business' needs may be complicated and time-consuming. It requires a deep understanding of both machinery and the related operational risks, which could be understood without complexities.

• Add-On Costs: Consequential losses, business interruption, or extended warranty on electronic components are some of the additional coverage options available. Since companies have to buy these additional options, the overall cost of the insurance increases.

8. Not Suitable for All Malaysian Businesses

• Small Businesses May Not Benefit: For businesses that are not heavily reliant on machinery, or for which machinery is inexpensive, the cost of premiums may outweigh the benefits of coverage. It may be more economical in this respect for small businesses to deal with repairs and replacements out-of-pocket rather than investing in insurance.

9. Malaysian Coverage May Not Be Immediate

• Waiting Periods: Sometimes, insurance comes with a waiting period prior to the start of coverage. Essentially, breakdowns that occur in the waiting period are not covered. Companies should, therefore, take this gap into consid eration when looking to purchase such insurance.

eration when looking to purchase such insurance.

• Delayed Payouts: Even upon approval of an insurance claim, delays could occur in payout, depending on the process of the insurance company involved. This will influence how soon repairs will be effected and hence the resumption of operations.

Machinery Breakdown Insurance, although useful in Malaysia to protect the owners of establishments from financial risks pertaining to machinery failure, is weighed against a number of disadvantages that businesses have to consider. These disadvantages include but are not limited to high cost, exclusions, strict maintenance requirements, and probably disputes over claims.

The Insurance Policy on Machinery Breakdown in Malaysia is designed to protect businesses against losses that may be incurred due to sudden and unforeseen breakdown of machinery. The policy is generally tailored for industry categories that are highly reliant on machinery, which includes manufacturing, building, and construction, agriculture, and where mechanical or electrical plants are in essential use.

Following is the key components and aspects of Machinery Breakdown Insurance policy in Malaysia:

1. Scope of Coverage

• Sudden and Unforeseen Breakdown: The insurance covers damages or breakdowns that happen unexpectedly, including mechanical or electrical failures. This includes damage caused by internal defects, human error, or external factors like power surges.

•Covered Machinery: The Malaysian policy can also cover a wide array of machinery and equipment, including but not limited to production machinery, manufacturing equipment, construction equipment, HVAC systems, compressors, boilers, and many more.

•Coverage for Repairs and Replacement: Coverage allows the costs of repairing or replacing the machinery, including parts and labor associated with the repairs.

2. Inclusions

• Malaysian Mechanical or Electrical Failure: Mechanical defects, electrical failure, short circuits, and failure of internal components are usually covered against breakdown.

• External Causes of Damage: The policy could insure the machinery against external causes of loss such as sudden fluctuations in voltage or surges or even human error causing accidental damage.

• Parts and Labor Costs: In addition to this, the Malaysian insurance policy covers spares, labor charges, and other incidental expenditures for restoring and / or replacing the machinery.

3. Exclusions

• Wear and Tear: Loss in any form is usually denied if it is because of normal wear and tear or gradual deterioration due to the aging process.

• Corrosion and Rust: Any loss arising because of corrosion, rust, or any chemical action and reaction over the period is generally not covered.

• Bad Maintenance: Any breakdown due to improper Malaysian service of machinery as per the Malaysian manufacturer's recommendations or even improper usage is excluded from cover.

• Pre-existing Malaysian Conditions: Anything that was wrong before the date of buying the Malaysian policy, issues, or defects existing prior to the policy date are not covered.

Malaysian War, Terrorism, and/or Natural Disaster: Refers to damage induced by war, terrorism, flooding, earthquakes, and other natural disasters. This would usually not be covered unless there was a different policy to that effect.

Posted on 2024/10/07 09:08 AM